| Subscribe to our YouTubeChannel |

|

|---|

Unless it stops its planned Rs 5,000 crore loan to Adani’s Carmichael coal mine in Australia, French Asset Management Company Amundi has threatened to sell off SBI green bonds held by it.

- After PM Modi visited Australia in 2014, SBI approved a $1 billion loan to finance Adani’s Carmichael coal mine project in Queensland.

- Carmichael is a thermal coal mine under construction in Central Queensland’s Galilee Basin.

- In 2010, Adani won the right to mine coal from it. Since then the project has been fraught with controversy.

As one of the largest investors in India’s State Bank of India (SBI), France-based Amundi threatened to sell off SBI green bonds held by it unless it stopped its planned Rs 5,000 crore loan to Adani’s Australian Carmichael coal mine.

We believe that this project should not be funded by SBI. Ultimately, it is their decision, but we have been extremely clear that we would disinvest immediately if they decided to do so, “We consider SBI should not finance this project. Ultimately it’s their decision but we’ve been extremely clear on the fact that if they decide to do it, we would immediately disinvest,”

He added that financing the mine would be in “total contradiction” with the SBI’s activities financed by its green bond.

“We have engaged SBI asking them not to participate (in the loan) and now we are waiting for their answer” he was quoted as saying.

Amundi, which holds green bonds from the SBI as part of its Amundi Planet Green Emerging Fund, said it recently learned that the public lender is planning to fund Australia’s controversial coal mine project.

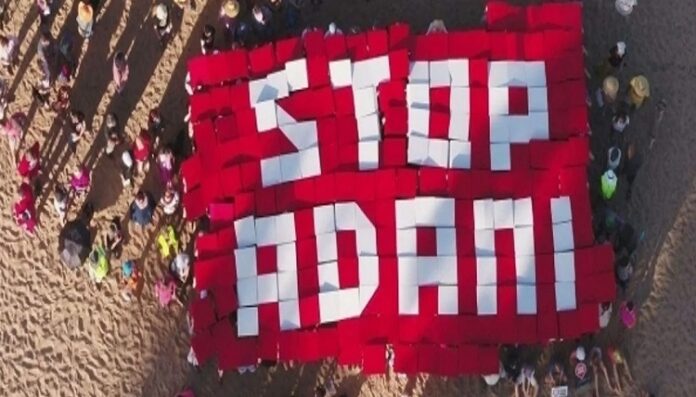

Since its inception as activists due to environmental problems it poses, Adani’s billion dollar Carmichael coal mine project in Queensland, Australia, has been the focus of many controversies.

The development comes within days of Samsung Securities, the South Korean conglomerate’s investment arm, announcing that it will not back the project after protesters targeted it for having links to the coal miner.